Hedge fund creator Ray Dalio is the latest billionaire — admittedly made so from capitalism – complaining about capitalism, arguing that it creates unending spirals of unfair wealth and income inequality.

In a lengthy op ed post on LinkedIn, Dalio, the Bridgewater Associates founder, blasts what he sees as the failure of capitalism for reportedly not providing any real wage growth or progression for the bottom three-fifths of America since the 1990s. He then lays out a series of depressing charts as proof of his argument.

But I look at these charts and see another obvious pattern. Great innovation has always preceded increased wealth gaps as investors make high capital returns while low wage/low skilled workers become more undervalued and displaced. Think the industrial revolution and the titans of industry, the advent of the internet and cell phones, outsourcing manufacturing globally, the rise of e-commerce displacing brick stores, and now the reality of social media, big tech, AI and robots not only taking over low skilled jobs but all jobs… eventually.

The Solution?

And the solution for fixing these “capitalism created wealth gaps” promulgated by these tax-the-rich billionaires and the Alexandria Ocasio-Cortez’s of the left is this line of thought that taxing the wealthy even more is fair. It is not. America already has an extremely progressive tax system – where 44 percent of Americans paid ZERO federal income tax in 2017 (not including payroll taxes).

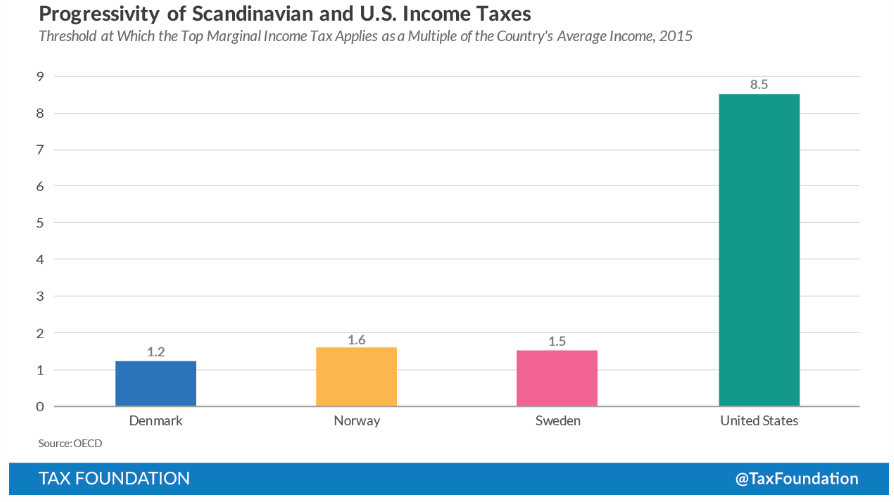

But the bigger fallacy – the big fat whopper that is being peddled by many during this 2020 election gear-up is that by taxing the rich more, it will raise enough revenue to force society into fairness because we will finally achieve government provided medical care and university education – as a right. What?! These people, like Vermont Senator Bernie Sanders who points to the Scandinavian countries of Denmark, Norway and Sweden as shining examples of just such fairness, conveniently forget to tell you that the tax burden in these countries is NOT just left to the rich.

No. No. No. These three countries barely have a progressive tax system – as the financial burden of such massive programs is felt at the middle class and even the lower class levels as well.

For example, in the U.S., a single person earning $60,000 a year using the standard deduction would only be in the 12 percent marginal tax bracket and would pay an effective tax of around 10.75 percent. But in Denmark, where health care and education are free, earning the U.S. equivalent of $60,000 puts that person’s tax rate right around 60 percent.

Does this 60 percent tax on a person making $60,000 sound like taxing-the-rich? Who are they kidding?

This tax-the-rich line of thought is a façade, obscuring the fact that by rich, they really mean even those making $60,000 per year. Because massively taxing just the super-rich, or even the top 1 percent, would not begin to provide the funding required for the government programs of a socialist system.

In reality, capitalism has provided the highest per capita standard of living in the history of the world. Human progress forward, which means the old ways are outmoded, will always come with some growing pains but that does not mean we should not progress – it just means we need to adapt – and we will…

Ms. Walser’s blog post was featured in Fox Business and the front page of Fox News – You can check out the link below:

Browse our website to learn more about Rebecca’s wealth management experience and services.